Can you claim the home office tax deduction if you've been working remotely? Here's who qualifies - MarketWatch

![IRS TAX DEDUCTION: Home [Medical] Office | The Leading Business Education Network for Doctors, Financial Advisors and Health Industry Consultants IRS TAX DEDUCTION: Home [Medical] Office | The Leading Business Education Network for Doctors, Financial Advisors and Health Industry Consultants](https://www.whitecoatinvestor.com/wp-content/uploads/2020/04/3-Rules-Home-Office-238x238.jpg)

IRS TAX DEDUCTION: Home [Medical] Office | The Leading Business Education Network for Doctors, Financial Advisors and Health Industry Consultants

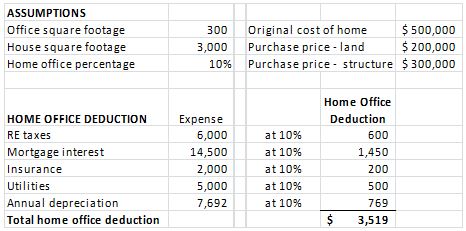

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b3beeeb5b066ac98f471_home-office-expenses-spreadsheet-dragging-down-formula.png)

.jpg)

:max_bytes(150000):strip_icc()/HomeOfficeDeduction-46bf6befa1de4a1a9972d9a642464cbc.jpeg)

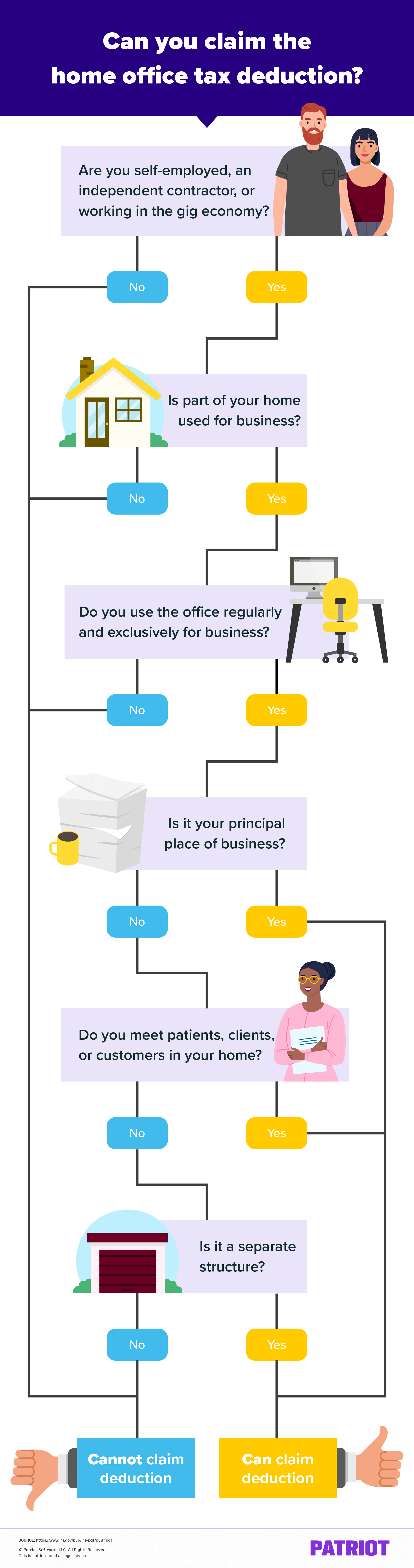

![Can I Take the Home Office Deduction? [Free Quiz] Can I Take the Home Office Deduction? [Free Quiz]](https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/635c647797c263283309177a_Home%20Office%20Guide%20(5).png)